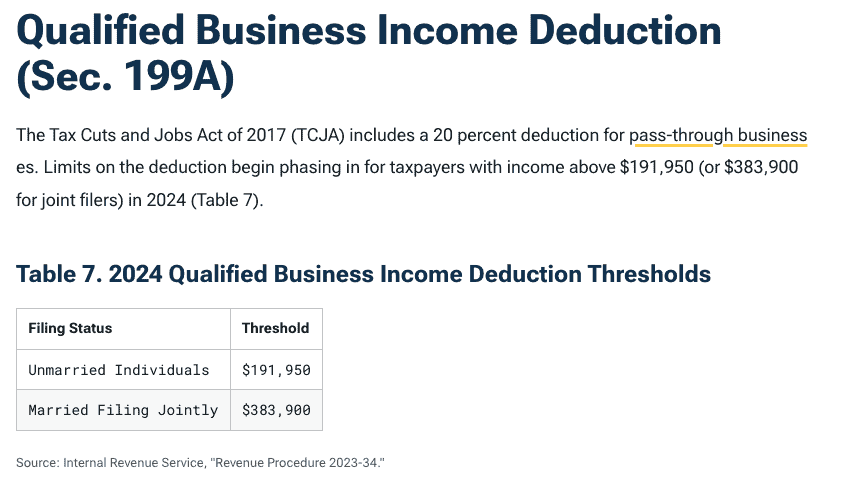

Qualified Business Deduction 2024 Table – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . When deciding between the standard deduction and itemized deductions, pick whichever one is higher. (Small business owners amounts from 2022 to 2024, check out the table in the image for .

Qualified Business Deduction 2024 Table

Source : www.castroandco.com2020 tax brackets Archives Per Diem Plus

Source : www.perdiemplus.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.orgWhat is Form 8995? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govHow to Qualify for a Private Student Loan Interest Deduction

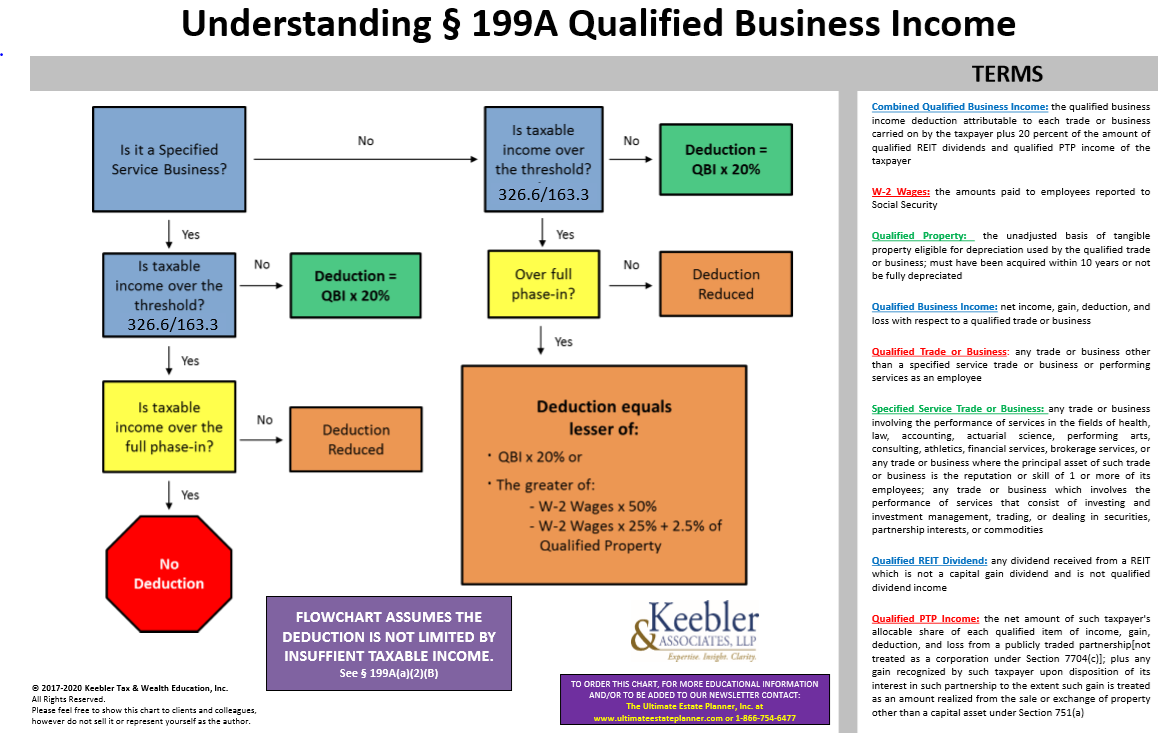

Source : www.studentloanplanner.com2024 Section 199A Chart Ultimate Estate Planner

Source : ultimateestateplanner.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comM & M Bookkeeping, Tax, and Business Services | Bristol TN

Source : www.facebook.comQualified Business Deduction 2024 Table Home Office Deduction for Small Business Owners | Castro & Co. [2024]: However, some building improvements now qualify for the deduction. Value limit: All companies that lease, finance or purchase business equipment valued at less than $3,050,000 for 2024 qualify for . These deductions Business (SEP, SIMPLE, and Qualified Plans).” Internal Revenue Service. “Types of Retirement Plans.” Internal Revenue Service. “401(k) Limit Increases to $23,000 for 2024 .

]]>